The prices of raw materials used in steel making, such as iron ore, coal and scrap metal are expected to keep on rising for many years, keeping pressure on manufacturers and consumers, said the chief of US steel maker Nucor Corp.

The prices of raw materials used in steel making, such as iron ore, coal and scrap metal are expected to keep on rising for many years, keeping pressure on manufacturers and consumers, said the chief of US steel maker Nucor Corp.According to Mr. Dan DiMicco (the chairman, president & CEO of Nucor Corp.), “the bull run for commodities market will continue for decades to come and so the people need to get used to it”.

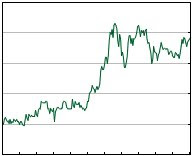

This can be seen from the market, where iron ore is up several hundred per cent, scrap prices are $600 (U.S.) to $700 per ton, pig iron is $900 per ton, and coal is escalating at an even fast pace. According to Mr. Dan DiMico, “raw materials, including scrap, will continue to see rise in prices”.

Earlier, Mr. John Surma (CEO – U.S. Steel Corp.) told Reuters that “high iron ore costs were pushing steel prices even greater and he warned that increasing demand is limiting miners' capacity to provide raw materials”.

Steel prices have surged around 50 percent this year and this can be attributed to continuously increasing raw material costs and the global demand.

Escalating Scrap

Nucor produces majority of its steel from scrap metal, the cost of which has increases twice than what it was last year and seventy percent more than 3 months ago.

Scrap is the primary feedstock for electric arc furnaces ran by mini-mill steel makers such as Nucor, while structured steel manufacturers such as U.S. Steel Corp. make their products in blast furnaces that use coking coal to melt iron ore.

Recently Nucor has moved to more secure supplies. The Charlotte, North Carolina-based company is the biggest buyer of ferrous scrap in North America with aggregate scrap purchases of 22.8 million tons in 2007.

Earlier this year, the company paid $1.44-billion for scrap processor David J. Joseph Co. and recently acquired the assets of Galamba Metals Group that run 16 scrap-working facilities in Kansas, Missouri and Arkansas, and Metal Recycling Services Inc., established in Monroe, North Carolina.

According to Mr. DiMicco, the future looks bright for steel industry with increasing global demand, especially from China, India and other emerging economies. He compared the situation with that of the late 1940s and early '50s, when the industry was being reconstructed after the destruction of World War II.